[Feature] Tabacco Tax Hike: Affects Everybody

As the average retail price of cigarettes in Korea has been frozen at 2,500 Korean Won for the past decade, the Korean government's recent announcement on the proposed tobacco price increase was a rather unexpected one to many Koreans. However, other countries have already been engaging in long fights with tobacco by implementing various policies and campaigns, including taxation.

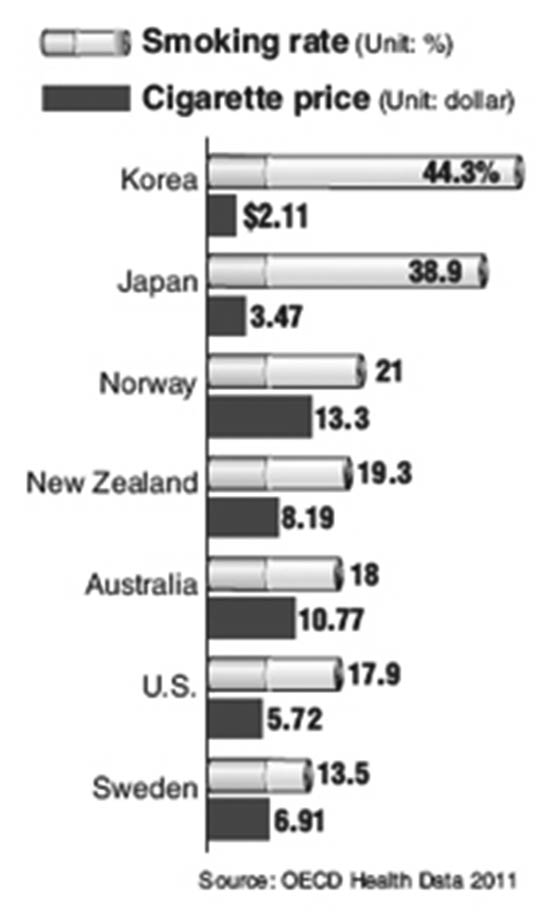

What are the cigarette prices in other countries? The government says that Korea has the cheapest cigarettes among the 34 Organization for Economic Cooperation and Development (OECD) members, followed by Mexico with $2.37, per pack. Poland, Estonia, and Hungary also show low prices, $2.59, $2.66, and $2.8, respectively. More surprisingly, Korea and Japan were the only two countries among the surveyed OECD countries that had cigarette prices lower than that of a Big Mac, according to The Economist in 2010. On the other end of the spectrum, Norway has the highest price of $14.40, followed by Ireland and New Zealand with $11.90 and $11.60 respectively, according to a recent study conducted by the World Health Organization (WHO).

Interestingly, the tobacco price and the smoking rate show a close, inverse relationship across countries. Korea had the second highest smoking rate of 44.3 percent, following Greece with 46.3%. The OECD countries that had the cheapest cigarette prices after Korea also showed relatively high smoking rates with Estonia at 38.6%, Poland at 33.5, Hungary at 31.9, and Mexico at 21.6.

As demonstrated by various statistics, many countries have manipulated their cigarette prices to decrease the demand. The WHO Framework Convention on Tobacco Control (WHO FCTC) introduced MPOWER measures, a policy package launched in 2008, in order to assist in the country-level implementation of effective interventions to reduce the demand for tobacco. The six evidence-based components of MPOWER are the following: Monitor tobacco use and prevention policies; Protect people from tobacco use; Offer people help to quit tobacco use; Warn about the dangers of tobacco; Enforce bans on tobacco advertising, promotion and sponsorship; Raise taxes on tobacco. The WHO agrees that tobacco taxes are by far the most cost-effective way to reduce tobacco use, since a tax hike that increases tobacco prices by 10% decreases tobacco consumption by 4% in high-income countries and about 5% in low and middle-income countries.

Korea also saw the effects of a tobacco tax one decade ago. The overall smoking rate dropped from 57.8% to 44.1%, after the government raised cigarette prices by 500 Korean Won in 2004. France and the United Kingdom have implemented more extreme tax policies than Korea has. France increased its tobacco price by 40% in 2003, which resulted in a 33% decrease in the overall cigarette consumption, the following year. Between 1992 and 2011, the price of cigarettes in the United Kingdom rose more than 200%. During the same period, cigarette sales declined by 51% from 85.7 billion sticks in 1992 to 42 billion sticks in 2011. Although there were no changes in adult smoking rates between 1994 and 2000, the rates dropped significantly from 27% in 2000 to 20% in 2010. In Turkey, the taxes have steadily increased to 84.2% since 2008, due to the implementation of other policies, including bans on indoor smoking and tobacco advertising. This package of cigarette-related policies has led to a significant decline in smoking by 13% between 2008 and 2012. Also, a reduction in prevalence among adults was found, from 31.2% to 27.1%, during the same period.