[Feature] Tabacco Tax Hike: Affects Everybody

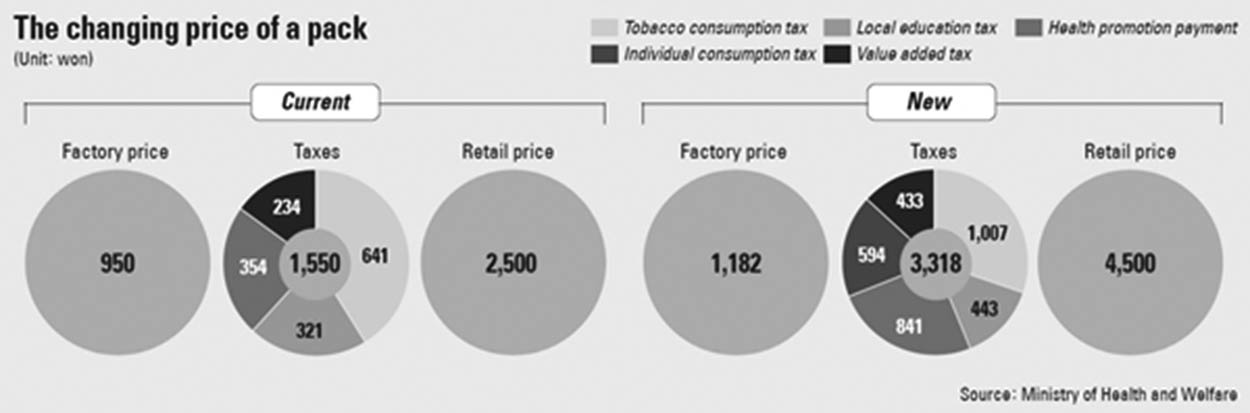

Currently the cigarette price in Korea is divided into two main parts: the factory price plus the retail margin and taxes. The retail price of a pack of cigarette is 2500 Korean Won, with 950 Won going to the cigarette companies and retailers and the government taking the remaining 1550 Won. The taxes include tobacco consumption taxes, local education taxes, health promotion payments, and VATs (value added tax). Now the government is planning to increase the price by 2000 Won, making the retail price 4500 Won.

If all goes according to plan, the factory price plus the retail margin will be increased to 1182 Won, while the taxes will be set at 3318 Won. In addition to increasing the existing taxes, the government will add an individual consumption tax; the government will adjust the taxes according to inflation rates. The Ministry of Strategy and Finance (MSF) predicts an increase in tax revenue of 8 trillion Won per year.

While the proposed price may seem arbitrary, a report by the Korea Institute of Public Finance shows there may be good reason behind it. A graph in the report "The Effect and Finance of Tobacco Taxation," called the Laffer curve shows the relationship between the tobacco price and additional tax revenue. The peak of the graph is at 4500 Won, with 2.7 trillion Won expected in additional tax revenue.

The cigarette price in Korea is one of the lowest among Organization for Economic Cooperation and Development (OECD) countries. However, when the government increased the cigarette price by 500 Won in 2004, the smoking rate dropped by 12 percent. Tobacco sales fell from 100 billion Won to 82.3 billion Won in 2005.

Of course, the government doesn't want the people to think that the price hike is for increasing tax revenue. According to an OECD report, the smoking rate of Korean men over 19 is 44 percent, the fourth largest among OECD countries, whereas the average smoking rate of OECD countries is only 25.8 percent. The government wants to lower the number to 29 percent by 2020, by raising the price of tobacco.

According to the Korea Health Promotion Foundation, when asked about the tobacco price increase, 64.5 percent agreed with the plan. Also, 32.3 percent said that they would quit if the price rose.

While there are many ways to lower the smoking rate, many experts would argue that one of the most effective ways is to increase the tobacco price. The government assures the smokers that around 19 percent of the revenue gained from the proposed cigarette price (4500 Won) will go to the National Health Promotion Fund to help smokers.

The Ministry of Health and Welfare, the Ministry of Security and Public Administration, and the MSF announced that the price increase would start next year.

In order for the new policy to be implemented though, it must be approved by the National Assembly. However, both the ruling and opposition party are expressing concerns about the price increase. The spokesman for the New Politics Alliance for Democracy said that the price increase is a trick to make up for the tax shortage by exploiting working-class people and smokers, and the government should reconsider the plan.

The delegate of Saenuri Party expressed concern that while increasing the cigarette price is an effective way of lowering the smoking rate, the amount of price increase should be carefully decided.

Interestingly, President Geun-hye Park opposed the increase in cigarette price back in 2004. President Park, who was the former delegate of the Grand National Party (GNP), said that increasing the tobacco price would devastate the people. During the vote on whether to revise the law regarding tobacco price increase, President Park abstained, while the current Minister of Strategy and Finance Choi Kyoung-hwan, back then a congressman of GNP, had cast a dissenting vote.

Skeptics of the tobacco price increase claim that its goal is to aid public finance, which has suffered due to the increase in the welfare budget. They also say that President Park has failed to keep the promise of 'welfare without increases in tax,' one of the campaign slogans during the 2012 Presidential Election.

While the bill regarding the tobacco price hasn't been finalized, it is evident that the Park Geun-hye Administration wants to push ahead with the price increase. However, with the political parties strongly divided on the Sewol Ferry Act as well as other agendas, it is unclear whether the National Assembly will ever agree on the price the government proposed.